India’s FMCG market is on a steep growth trajectory, projected to reach USD 220 billion by 2025, driven by diverse retail channels. General Trade (GT), powered by millions of kirana shops, has long been the backbone, while Modern Trade (MT), with supermarkets and e-commerce, caters to urban consumers. The rise of Quick Commerce (Qcomm), led by platforms like Zepto and Blinkit, adds a new dimension with ultra-fast delivery. However, Qcomm cannot replace GT or MT due to their unique strengths and entrenched roles. This blog explores the key differences, growth opportunities, and why all three channels are complementary in shaping the future of FMCG in India.

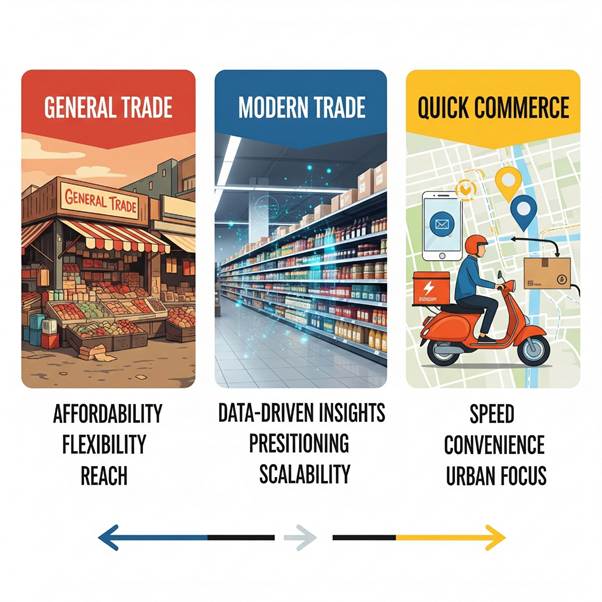

A Comparative Look at Channel Strengths

General Trade (GT)

General Trade, which includes millions of local kirana shops and grocers, remains the backbone of the FMCG sector. Its dominance in rural and semi-urban areas is built on strong community ties and a deep understanding of local needs.

- Affordability: Low operational costs allow these shops to offer competitive pricing.

- Flexibility: They can quickly adapt to local demand, ensuring product availability.

- Reach: Their extensive, deep penetration into remote areas is unmatched by other retail formats.

Modern Trade (MT)

Comprising supermarkets, hypermarkets, and large e-commerce platforms, Modern Trade caters to the urban consumer seeking convenience, variety, and a premium shopping experience. Its operations are powered by technology and data.

- Data-Driven Insights: Advanced analytics provide valuable consumer behavior data, enabling strategic decisions and targeted promotions.

- Premium Positioning: This channel is ideal for brands looking to showcase high-margin, innovative, and branded products.

- Scalability: Centralized logistics and standardized operations allow for efficient expansion.

Quick Commerce (Qcomm)

Quick Commerce has emerged as a new frontier in urban retail, leveraging a tech-driven model of dark stores and hyper-local logistics. Its primary value proposition is unparalleled speed and convenience.

- Speed: Ultra-fast delivery caters to instant purchases and urgent consumer needs.

- Convenience: The app-based ordering process and real-time tracking offer a seamless user experience.

- Urban Focus: Quick Commerce thrives in metros and tier-1 cities with a high density of digital-first consumers.

Why Quick Commerce Cannot Replace GT or MT

While Qcomm is transforming urban FMCG retail, it cannot supplant GT or MT due to their distinct advantages:

- General Trade’s Unmatched Reach: GT’s millions of kirana shops serve rural and semi-urban areas where Qcomm’s infrastructure is not viable. The personal touch, credit facilities, and localized offerings make GT irreplaceable for a vast consumer base.

- Modern Trade’s Premium Appeal: MT offers a broader product range, in-store experiences, and premium positioning that Qcomm’s limited inventory cannot match. Supermarkets and e-commerce platforms cater to planned purchases and bulk buying, unlike Qcomm’s focus on small, immediate orders.

- Operational Limitations: Qcomm relies on dark stores with limited SKUs, high operational costs, and urban-centric models, making it complementary rather than a replacement for GT’s volume-driven reach or MT’s data-driven scalability.

Comparing General Trade, Modern Trade, and Quick Commerce

| Attribute | General Trade (GT) | Modern Trade (MT) | Quick Commerce (Qcomm) |

| Market Share | 70–75%, rural and semi-urban focus | 20–25%, urban focus | ~5–10%, urban-centric, rapidly growing |

| Operations | Trust-based, manual, relationship-driven | Tech-enabled, standardized, automated | Hyper-local, tech-driven, instant delivery |

| Consumer Reach | Local, community-oriented | Urban, variety-seeking | Urban, convenience-driven |

| Pricing & Promotions | Flexible, credit-based, negotiation-driven | Fixed pricing, app-based discounts | Dynamic pricing, app-based offers |

| Supply Chain | Fragmented, local distributors | Centralized, optimized logistics | Hyper-local dark stores |

| Growth Rate | Stable at 8–10% annually | Accelerated at 15–20% annually | Explosive at 25–30% annually |

GT drives volume through widespread reach, MT excels in premiumization and variety, and Qcomm dominates in speed and convenience. Together, they address diverse consumer needs.

Growth Opportunities Across Channels

General Trade

- Digital Penetration: Tools like Sales Force Automation (SFA) and Distributor Management Systems (DMS) enhance transparency and efficiency.

- Expanding into Untapped Markets: With over 65% of India’s population in rural areas, GT remains FMCG’s biggest growth driver.

- Localized Marketing: Leveraging personal relationships to push loyalty programs.

Modern Trade

- Premiumization: Urban consumers are more likely to buy premium and innovative products.

- Omnichannel Expansion: Integrating offline and online channels to expand reach.

- Data-Driven Strategy: Real-time analytics for targeted promotions and inventory optimization.

Quick Commerce

- Rapid Scaling: Expanding to tier-2 cities with growing digital adoption.

- Category Diversification: Adding high-margin categories like personal care and premium snacks.

- Partnerships: Collaborating with FMCG brands for exclusive launches and promotions.

The Future of FMCG Retail in India

The FMCG retail landscape is evolving into a phygital ecosystem, blending physical reach with digital intelligence. Kirana stores are adopting UPI, barcode scanning, and inventory tools, while MT integrates regional products to add a local touch. Qcomm, while revolutionary, complements rather than replaces GT and MT by catering to instant needs. For FMCG brands, success lies in leveraging all three channels to maximize reach, efficiency, and consumer engagement.

How MAssist Drives FMCG Success Across All Channels

MAssist provides FMCG brands with advanced sales and distribution management solutions to optimize General Trade (GT), Modern Trade (MT), and Quick Commerce (Qcomm), ensuring seamless integration and scalability across channels:

- General Trade: Enhances operational efficiency with Sales Force Automation (SFA) for real-time sales tracking and Distributor Management Systems (DMS) for streamlined inventory and order management, improving stock visibility and coordination with local distributors.

- Modern Trade: Integrates advanced data analytics to unify disparate data sources, enabling precise urban campaign targeting and optimized inventory allocation based on consumer trends and purchase patterns.

- Quick Commerce: Facilitates rapid order processing and real-time analytics to support hyper-local inventory management, ensuring efficient stock replenishment and alignment with Qcomm’s fast-paced delivery model.

By addressing operational inefficiencies in GT, data fragmentation in MT, and high-speed demands in Qcomm, MAssist empowers brands to scale dynamically and adapt to India’s evolving FMCG landscape.

Overcoming Challenges with Intelligent Solutions

GT faces challenges like poor stock visibility and inconsistent promotions, whereas MT deals with compliance costs and fragmented data silos. A hybrid strategy that integrates technology across both channels is critical. Brands can optimize GT distribution during peak demand seasons while leveraging MT insights to refine urban campaigns.

Practical tips:

- For General Trade: Train sales reps to build strong retailers’ relationships and emphasize stocking small, fast-moving SKUs.

- For Modern Trade: Invest in appealing in-store displays and app-based loyalty programs to engage urban consumers.

- For Qcomm: Prioritize high-demand, low-shelf-life products and collaborate with platforms for exclusive launches.

Conclusion: A Complementary FMCG Ecosystem Powered by MAssist

In 2025, General Trade, Modern Trade, and Quick Commerce are complementary pillars of India’s FMCG sector. GT offers unmatched reach and authenticity, MT drives efficiency and premiumization, and Qcomm delivers unparalleled speed and convenience. While Qcomm is transformative, its urban focus and operational constraints prevent it from replacing GT’s extensive penetration or MT’s scalability. By leveraging MAssist’s advanced sales and distribution tools, FMCG brands can build a hybrid retail engine that drives sustainable growth across rural heartlands, urban centers, and instant-delivery ecosystems.

Embrace the future by optimizing all trade channels, adopting digital innovations, and partnering with MAssist to unlock your brand’s full potential in India’s dynamic FMCG market.